2011 Retail Banking Brand Vulnerability Study | Summary of Key Findings

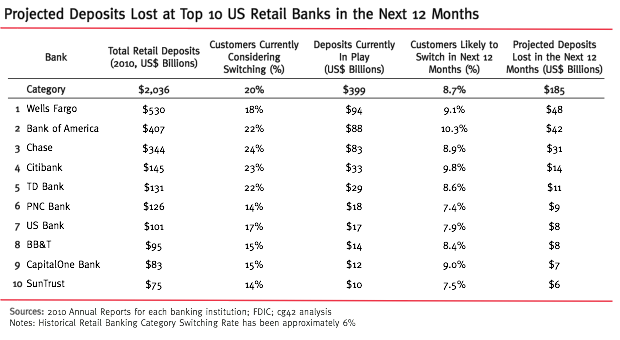

Based on the results of the Brand Vulnerability Study, the top 10 US retail banks are projected to lose a combined $185B in retail deposits over the next 12 months if existing customer frustrations are not addressed. Of the 10 banks, the Big Four (Bank of America, Chase, Citibank, Wells Fargo) have the most at risk and account for $135B, or roughly 73% of the total projected deposit losses over the next 12 months.

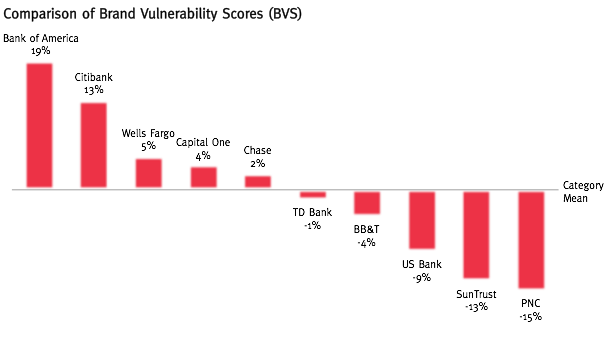

The top 3 most vulnerable banks by Brand Vulnerability Score are 3 of the Big Four, putting them at highest risk for customer defection and financial loss in the short term.

At the opposite end of the spectrum, PNC and SunTrust are the least vulnerable of the top 10 banks and stand to lose the fewest customers (as a percentage of their current customer base). Their projected customer loss stands at 7.4% and 7.5%, and their projected deposit loss at $9B and $6B, respectively.

Proportionally, Chase, Citibank, Bank of America and TD Bank have the most customers currently considering to switch. Whereas the category average stands at 20%, each of these financial institutions have more than 22% of customers considering a switch or ‘in play.’ From the sheer size of deposits, Wells Fargo, Bank of America, and Chase have the most to lose – with Wells having $94B, Bank of America $88B, and Chase $83B of its deposits currently in ‘in play.’